Are companies right to abandon the shareholder-first mantra?

Sarah Kaplan is invited by the Financial Times to explain why the Business Roundtable announcement is a good first step for change.

Are companies right to abandon the shareholder-first mantra?

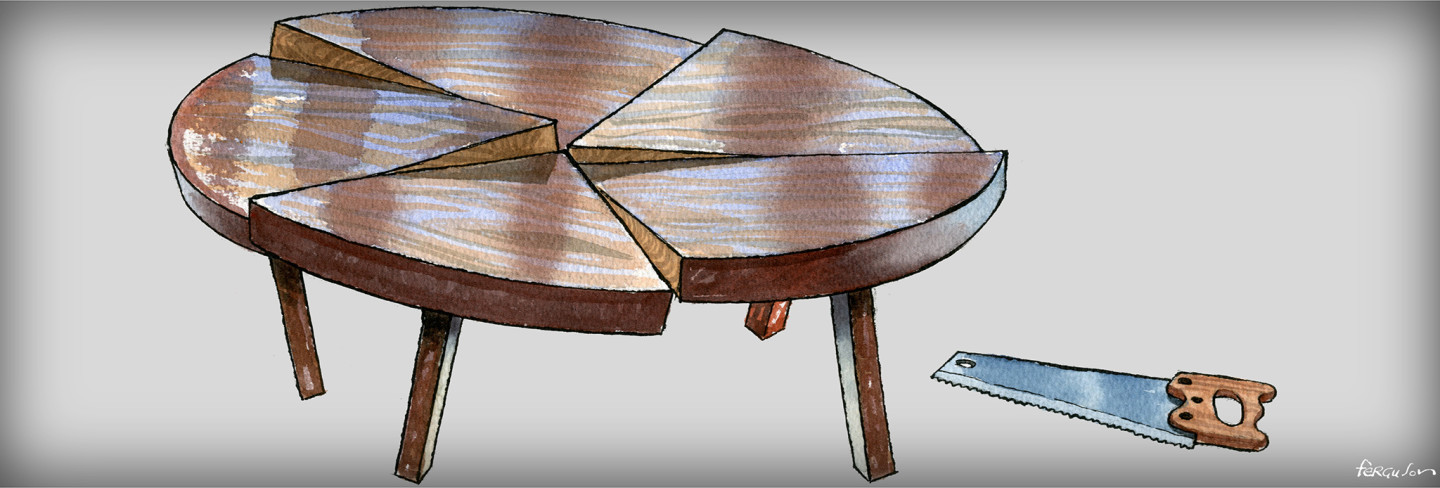

Yes — Balancing interests will spur companies to be more innovative The Business Roundtable, an association of leading US chief executives, last week announced plans to repudiate a singular focus on the interests of shareholders and instead pledged to “deliver value” to all stakeholders, writes Sarah Kaplan.

This is a big step for a group that had previously argued that stockholders were “paramount” and the “interests of stakeholders are relevant as a derivative of the duty to stockholders”. And, it is a necessary one.

In one day this month, Greenland lost 11bn tons of ice. In one week, the US experienced four mass shootings. In one year, the world sends 21bn tons of textile waste to landfills. In one decade, OECD countries have made almost no progress on the gender wage gap. Corporations are implicated in all these problems, and so must be part of the solution.

The Business Roundtable’s about-face takes guts. At the same time, these chief executives are facing a new reality as stakeholders make their voices heard in new ways. “Clicktivists” are creating social media storms about company mis-steps; consumers are shopping with their values; and millennial workers are walking away from jobs at companies that don’t behave responsibly.

Even shareholders want more than financial performance. BlackRock chief Larry Fink’s recent letter to the heads of the companies in which his group invests makes this clear by demanding that companies have purpose as well as profits. Research also shows that the investor base of more socially responsible companies shifts over time towards longer-term investors who don’t worry as much about boosting quarterly returns. Sovereign wealth funds and large pension funds are increasingly divesting from companies that do not meet social standards. Some $30tn (more than one-third) of global investable assets are now managed by socially responsible vehicles.

Considering the interests of all of the stakeholders that surround them will force company executives to manage multiple goals and look beyond the single-minded focus of the financial bottom line. Done badly, this could divert attention and lead to suboptimal outcomes on all goals. But, the work of psychologists and moral philosophers suggests that humans are capable of accommodating multiple values at the same time. Given what we know about the way cognitive biases can distort decision-making, having multiple objectives might actually help.

The Business Roundtable’s announcement is a strong indicator of its political will to address the conflicting interests of various stakeholders. But ensuring that this is not mere window-dressing will take skill. There are no easy solutions that have not been implemented already. To start, managers must become better at identifying the trade-offs in their business models. Then they should treat them as opportunities for innovation and rethinking the way they do business.

In the past, corporate social responsibility was often focused solely on making the business case to shareholders for investing a broader range of stakeholders. But this approach risks making only incremental changes, because the need to produce profits still dominates.

Instead, we need to think of stakeholder trade-offs as innovation challenges. Let’s say garment workers are spending dangerous amounts of overtime at their sewing machines. Rather than simply complying with factory safety standards, companies should rethink the way they design products and place orders so that time pressures don’t mount.

If you use toxic glues to assemble your running shoes, then you should invent an assembly process that substitutes 3D stitching for adhesives. In other words, this is not about incremental change. It is about transformation. Thoughtful companies will flourish in this more complex world.

The Business Roundtable announcement is an important first step; now CEOs must follow up with concrete action.